In the world of business, finance and accounting are often mentioned simultaneously – and for good reasons. Both these subjects form the foundation of organizational decision making, resource management and prolonged development. While they are closely connected, finance and accounting are different complementary objectives. Understanding their roles is essential for entrepreneurs, professionals and even individuals managing personal money.

Defines finance and account

Finance is the science of management of money. This includes plans, safe, investment and allocating money to achieve both short and long goals. Finance helps in answering such questions: How should the capital be raised? Which projects should receive money? How can the risk be reduced when maximizing returns?

On the other hand, financial transactions are a process of accounting, recording, classification and reporting. This ensures that all professional activities are accurately documented so that from stakeholders – from monkeys to investors and regulators – a clear picture of an organization’s financial health.

In short, the finance looks forward, while the accounting looks back. Finance is forwarded and strategic, while accounting is expanded and historical.

Role of accounting in business

Accounting provides “language of business”. Each financial transactions – whether it is sales, purchases or investment – has been occupied in accounting records.

These records are then used to prepare financial details like balance sheet, income statement and cash flow statement.

Through these reports, business acquires insight into profitability, liquidity and efficiency. For example, if accounting shows a decline in cash reserves, management can take corrective action. Additionally, accounting taxes ensure compliance with rules, auditing standards and other legal requirements, making it indispensable for transparency and accountability.

Role of finance in business

While the accounting creates the foundation, makes finance strategy. Finance professionals use accounting data to make decisions about investment, budget and development opportunities. For example, a company’s financial manager can analyze the cash flow report to decide whether to expand a new market or invest in new technology.

Finance in risk management is also heavy. By analyzing market trends, interest rates and credit risks, financial teams protect businesses from potential losses. In this way, finance increases development by maintaining stability.

How to work together

Although different, finance and accounting rely on each other. Accounting provides accurate data, while the finance uses that data for planning and project. For example, accountants can record the expenses of a company, and financial managers can use this information to predict the budget and formulate a strategy.

In today’s fast-paced business environment, many organizations integrate finance and accounting systems using digital tools. For example, Enterprise Resource Planning (ERP) software combines real-time accounting records with financial analysis equipment, allowing companies to make data-related decisions more efficiently.

Human side of finance and accounting

Beyond numbers and systems, finance and accounting affect people. They shape decisions about employees and communities, salaries and investment affecting work. They guide individuals in the management of individual budgets, save for retirement, and cost favorable.

final thoughts

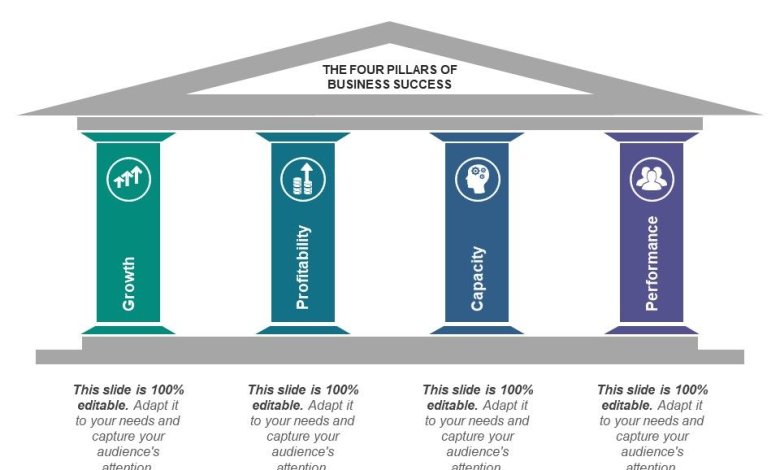

Finance and accounting are not just back-office functions-they are the twin columns of professional success. Accounting ensures accuracy and compliance, while finance provides vision and strategy. Together, they enable organizations to flourish into a competitive environment, ensuring both stability and development.